@techreport{watson_geeitc:2021,

Author = {C. Luke Watson},

Month = {9},

Title = {The General Equilibrium Incidence of the Earned Income Tax Credit},

Type = {Manuscript},

Year = {2021}}The General Equilibrium Incidence of the Earned Income Tax Credit

EITC

Labor Supply

Labor Demand

IV

Tax Incidence

My JMP

Favorite Graph

PDF links

Abstract

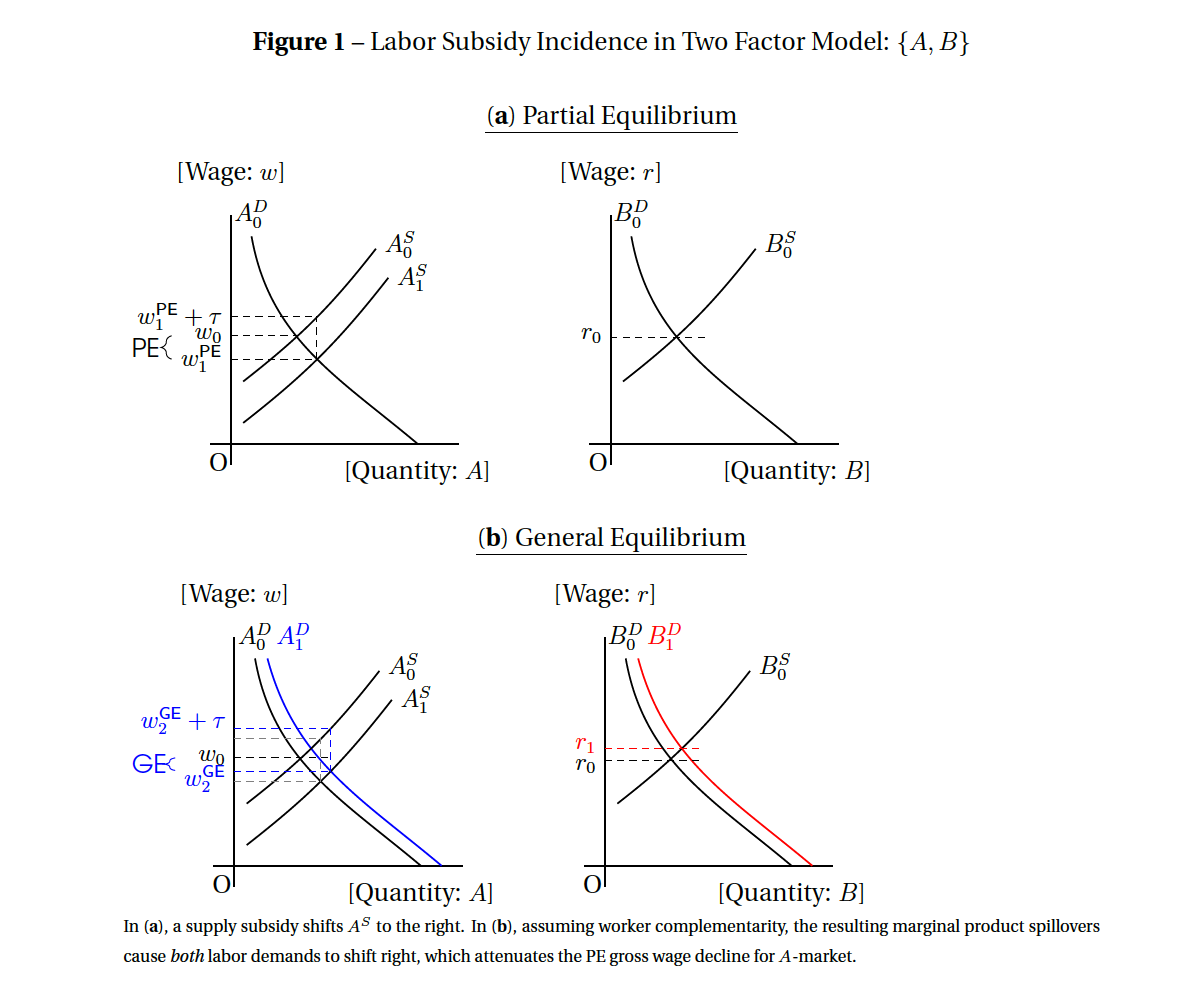

The Earned Income Tax Credit is a $67 billion tax expenditure that subsidizes 20% of all workers. Yet all prior analysis uses partial equilibrium assumptions on gross wages. I derive the general equilibrium incidence of wage subsidies and quantify the importance of EITC spillovers in three ways. I calculate the GE incidence of the 1993 and 2009 EITC expansions using new elasticity estimates. I contrast the incidence of counterfactual EITC and Welfare expansions. I quantify the effect of equalizing the EITC for workers with and without children. In all cases, I find spillovers are economically meaningful.