@techreport{watson_state_eitc:2021,

Author = {C. Luke Watson},

Month = {8},

Title = {The Local Effects of State EITC Expansions},

Type = {Manuscript},

Year = {2021}}The Local Effects of State EITC Expansions

PDF links

Abstract

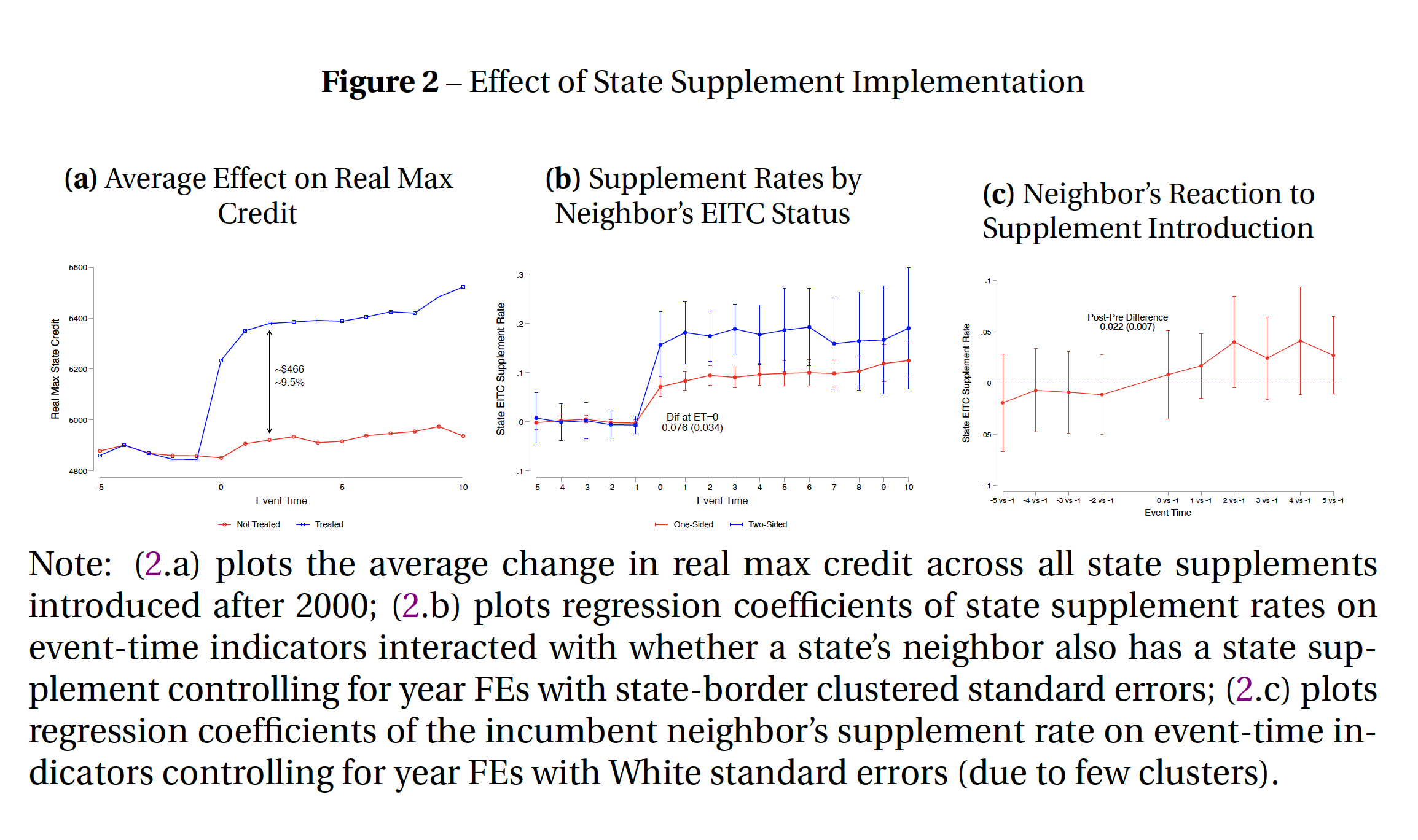

Twenty eight states spend $4 billion to supplement the federal Earned Income Tax Credit, with several justifying the tax expenditure as a pro-work incentive. Yet no systematic evaluation of these supplements exists. I use state border policy variation to identify state supplements effects. I first document that subsidy rates are greater when a state’s neighbor already has a supplement. Next, I assess whether supplements affect county level EITC take-up, migration, commuting, employment, and earnings. Estimates are sensitive to the estimation design and sample used. While supplements increase benefits to low-income workers, results fail to provide robust evidence of increased economic activity.

Note: the empirics on this paper are not finalized and should not be cited.

Graph from the paper

Timing and intensity of use

Possible policy coordination