@article{watsonziv_testforpricingpower:2025,

Author = {Watson, C. Luke and Ziv, Oren},

Title = {A Test for Pricing Power in Urban Housing Markets},

Journal = {Review of Economics and Statistics},

Year = {2025},

Note = {Accepted for publication}}A Test for Pricing Power in Urban Housing Markets

Rental Markets

Markups

Monopoly Power

Housing Demand

Building demand slopes down.

PDF links

- Paper (Updated, August 2025) – Accepted, Review of Economics and Statistics

Abstract

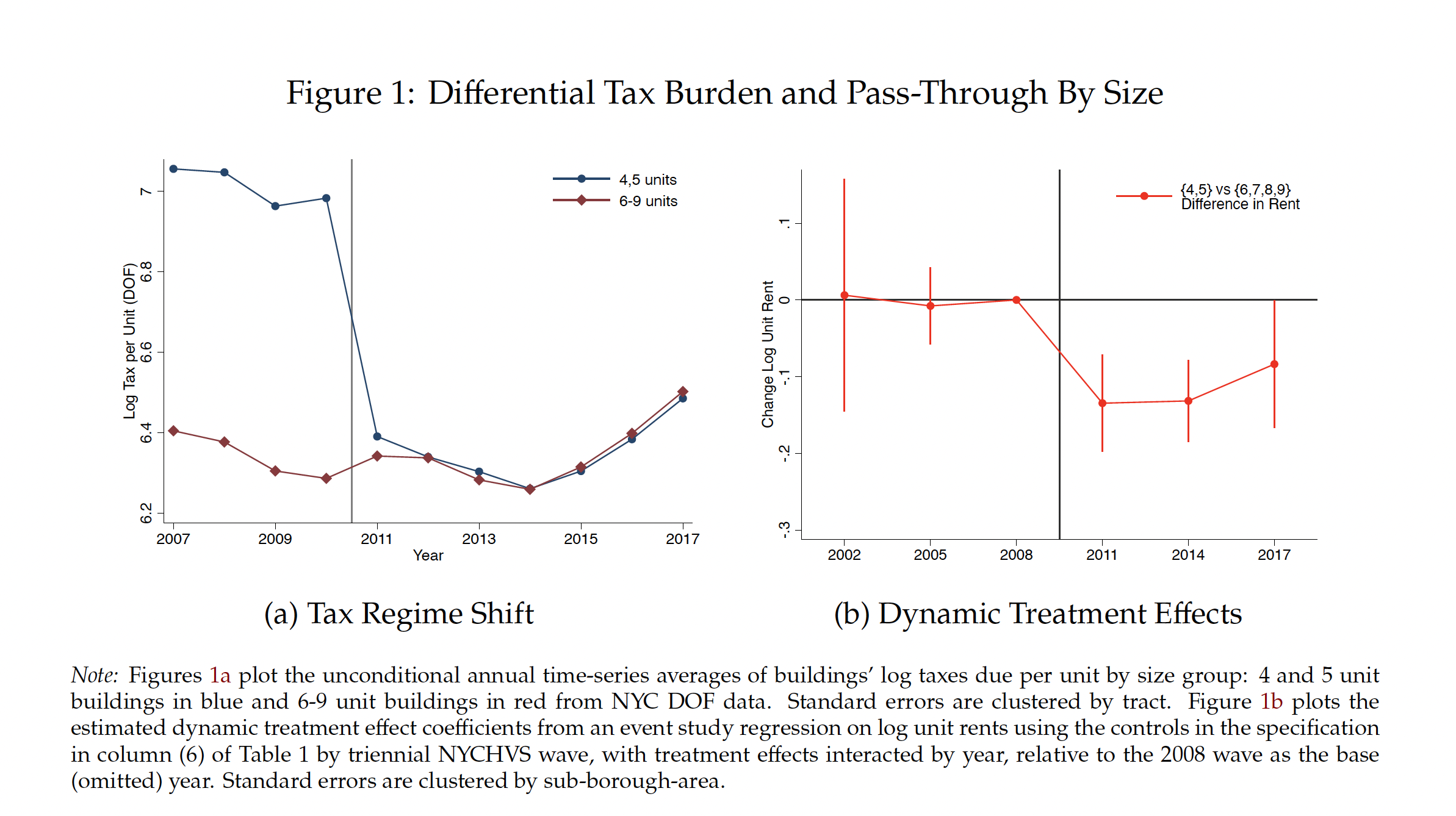

The presence of pricing power in housing markets significantly impacts our understanding of the housing supply. It biases estimates of housing production functions, supply elasticities, and the effects of land-use policies as well as the results of quantitative spatial models. We test for the existence of pricing power in the New York City rental market. Using tax policy changes, we conduct complementary difference-in-differences and instrumental variable analyses. An idiosyncratic increase in a single building’s costs leads to a proportional rent increase, holding market-level rents constant.

Our findings support the existence of pricing power and challenge the prevailing perfect competition framework.